This banking landscape report contains intelligence we gather from corporate treasury professionals about their banking and cash management relationships.

This banking landscape report contains intelligence we gather from corporate treasury professionals about their banking and cash management relationships.

This banking landscape report contains intelligence we gather from corporate treasury professionals about their banking and cash management relationships.

This banking landscape report contains intelligence we gather from corporate treasury professionals about their banking and cash management relationships.

This banking landscape report contains intelligence we gather from corporate treasury professionals about their banking and cash management relationships.

In Turbulent Times, European Institutions Turn to ETFs

Institutional allocations to exchange-traded funds (ETFs) rapidly grew last year, driven in large part by investors repositioning their portfolios in the face of an increasingly volatile and fast-changing market environment and the continued shift...

ETFs: U.S. Institutions' New Tool of Choice for Portfolio Construction

Investments in ETFs by U.S. Institutions increased significantly in 2018, with average allocations jumping to nearly 25% of total assets, up from almost 19% in 2017.

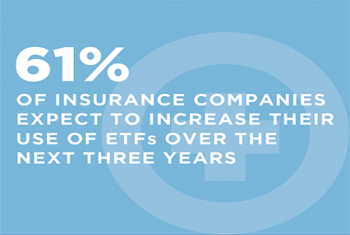

Insurance Company Investments in ETFs: Accelerating Growth Ahead

ETFs have long been used by insurance companies for equity exposure, but a change in the statutory accounting treatment of fixed income ETFs has helped open up the rest of an insurance company’s general account for increased use of the vehicle.

The Buy-Side Spending Battle: Compensation vs. Technology

The average buy-side trading budget grew 8% year-over-year, to $2.73 million.

This Competitive Challenges presentation covers a comprehensive analysis of sales, consultant relations, and client service productivity, including side-by-side comparisons with customized peer groups of competitors.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Traders: “We expect both broker-client relationships and broker competition to be more data-driven...August 19, 2025

-

The Trade: Speaking to The TRADE, Jesse Forster, head of equity market structure and technology at...August 14, 2025

-

GRR: “I think it’s the go-forward strategy for most of the banks, where you do have to lend to some...August 13, 2025