The boom in new corporate bond trading platforms is over. Institutional corporate bond investors have voted with their feet, utilizing those tools that work best within the current market structure. We are now in a phase of refinement, where the...

The boom in new corporate bond trading platforms is over. Institutional corporate bond investors have voted with their feet, utilizing those tools that work best within the current market structure. We are now in a phase of refinement, where the...

This report provides detailed information from institutional investors in the U.S. on return expectations, funding ratios, and much more.

This report provides detailed information from institutional investors in the U.S. on managers used and products most in demand across equities, fixed income, alternatives, and specialty investments segmented by geography, type of investor and size...

This report provides detailed information from institutional investors in the U.S. on current asset allocations in their investment portfolios.

This report provides detailed information from institutional investors in the U.S. on new business activity from key issues for plan sponsors and other institutional investors to size of expected mandates.

This report provides detailed information from institutional investors in the U.S. on expected shifts over the medium term in allocation changes.

This report provides detailed information from institutional investors in the U.S. on fees paid to investment management services.

This report provides detailed information from institutional investors in the U.S. on defined contribution, including insights into asset allocations, fees paid, and FTEs for DC plans.

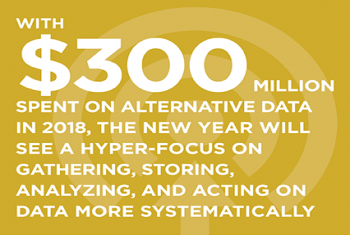

Market structure change over the past decade has been directly or indirectly catalyzed by the credit crisis of 2008. That post-credit crisis era is now over. Here are the Top 9 Market Structure Trends for 2019 from Greenwich Associates.

Learn about the major trends fueling the expansion of ETFs within the investment portfolios of U.S. RIAs, and how they will impact future investments and portfolio allocations.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder