In this Greenwich Report, we examine the role that selecting the right vendor plays in the overall success of technology transformations and how that vendor can help avoid many of the common pitfalls organizations encounter along the journey.

In this Greenwich Report, we examine the role that selecting the right vendor plays in the overall success of technology transformations and how that vendor can help avoid many of the common pitfalls organizations encounter along the journey.

In this paper, we examine the cloud and managed services transition, looking at where organizations are on the journey and how and why it’s a shift that needs to accelerate.

Whether utilizing or taking advantage of cloud technology, artificial intelligence (AI) or process automation, financial services firms are embracing innovation to propel their organizations into the new decade.

There is no lack of information today, but gathering it, analyzing it and acting on it still requires new technology and the wherewithal to use it.

The COVID-19 crisis has elevated the awareness of and need for portfolio liquidity, while also intensifying institutions’ need to enhance yields to address what could be acute, long-term funding shortages.

So where are financial advisors turning for information? The recent mandatory work-from-home response has led to more flexibility around when and where people are working.

The persistent growth trajectory of the trade surveillance technology market has surprised many industry participants.

In this Greenwich Report we look back at 2019 and attempt to peer past the coronavirus veil of uncertainty. We also examine how the buy side interacted electronically in 2019 and provide some insight into how that may change in 2020.

Institutional investors are considering brand strength more than ever when picking asset managers—and the COVID-19 crisis has intensified the importance of not just strength but also brand trustworthiness, authenticity, and purpose, putting asset...

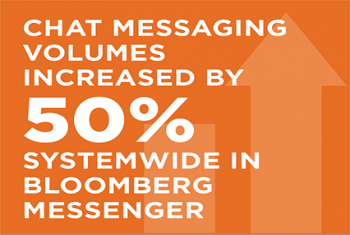

If the financial industry still held any objections to the case for providing firmwide communications flexibility and remote working capabilities, March 2020 saw the argument’s proverbial microphone drop.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder