Table of Contents

U.S. President Woodrow Wilson used the phrase “new world order” toward the end of the First World War to describe his vision for international peace, based on the belief that the world could no longer operate as it once had.

At Greenwich Associates, we believe that the COVID-19 crisis is a seminal event for the asset management industry from which a new world order will arise. For years leading up to the COVID crisis, the industry has pursued incremental enhancements to challenges related to operational efficiencies, alignment of interests and use of technology, marketing and client experience approaches.

The COVID crisis will lead to new thinking and approaches to address these challenges, driven by new business models, new pricing structures, greater outsourcing, and investments in technology and data.

But, let’s not get ahead of ourselves. The global war against the coronavirus and its impact on economic stability and market volatility continues to rage and will for some time. Until a vaccine is developed and widely distributed, the industry, like the world at large, will remain in a period of transition.

During this transition, the actions that asset managers take to prepare for the post-COVID environment will have lasting impact on their success once the war is finally won.

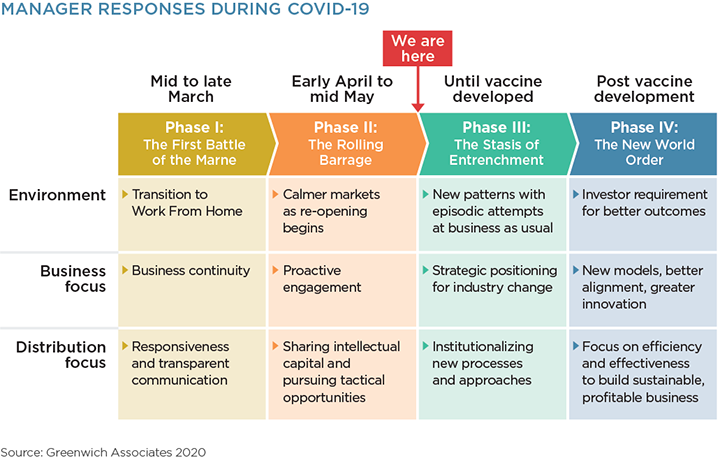

Phases of the War

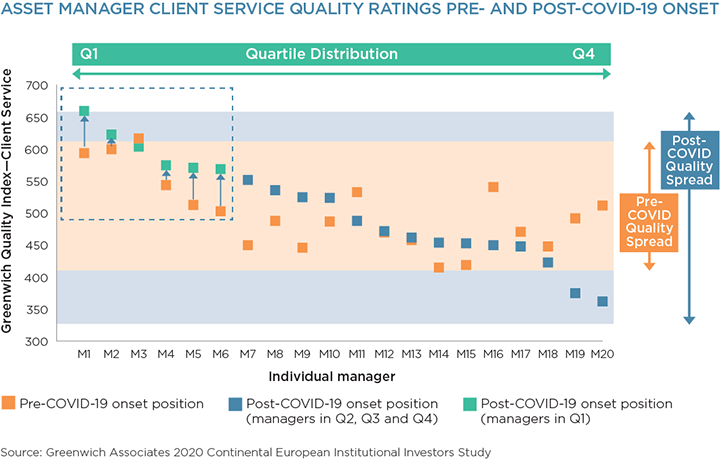

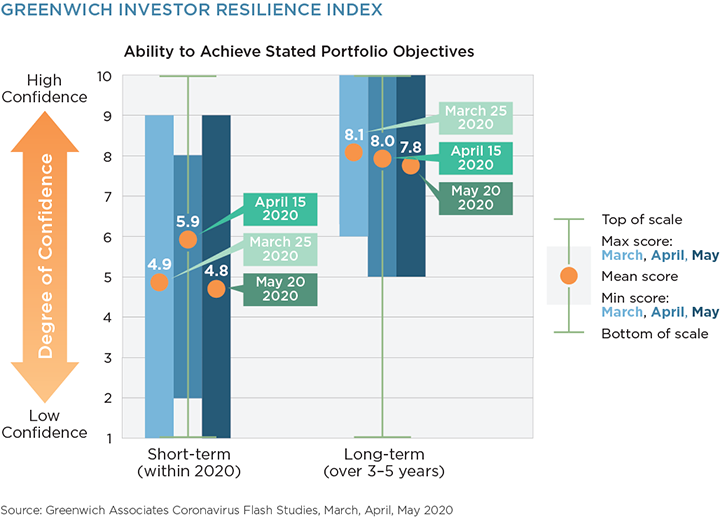

Over the past two months during the height of the COVID outbreak we conducted weekly “pulse” studies with asset owners, investment consultants and asset managers to provide real-time insights about rapidly evolving industry needs and best practices. Managers are responding to investors’ shifting needs, with the leading firms positioning themselves for long-term success.

Phase 1: The First Battle of the Marne

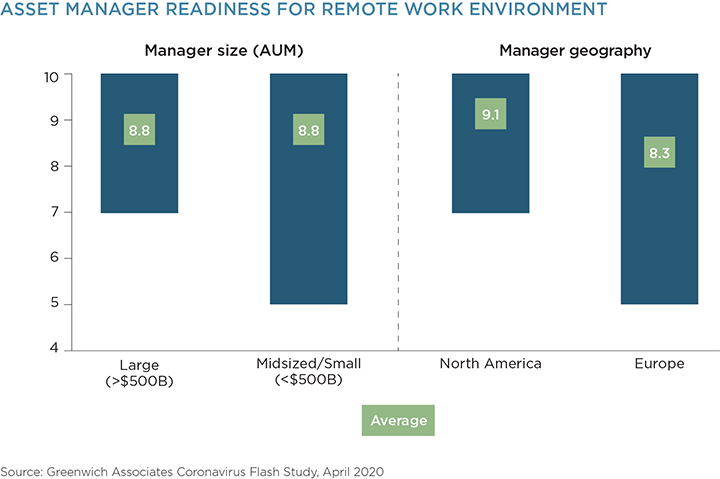

In the initial phase of their coronavirus response (mid-to-late March), asset managers were largely on the defense. A torrent of client and consultant inquiries about portfolio performance and market events arrived just as managers themselves were transitioning to a work-from-home environment.

Like the French and British soldiers in WWI counterattacking along the Marne River, early responses from managers during the COVID outbreak focused on daily newsletters, market intelligence and portfolio reports delivered during sometimes grueling 18-hour days. Although managers reported that they were relatively well prepared for the unexpected circumstances, the primary goal appeared to be responsiveness.

Phase 2: The Rolling Barrage

Soldiers in WWI used an offensive tactic, the “rolling barrage,” in which they would fire a hail of artillery as a curtain for infantry following closely behind, the purpose of which was to offer cover to advancing troops. Likewise, as markets stabilized in early April, managers shifted toward offense in the second stage of their response (early April to mid-May).

Calmer markets provided breathing room to establish a strategy aimed at proactive outreach to clients and consultants. Leading firms that already had cultures of service excellence were able to distance themselves from competitors through thought-provoking, opinion-oriented intellectual capital delivered through a variety of tech-enabled formats.

Phase 3: The Stasis of Entrenchment

Much of the western front of WWI was fought in the trenches in Belgium and France. Despite courageous fighting on both sides for prolonged periods of time, trench warfare often resulted in gains measured in mere feet (on a front that was hundreds of miles long).

In the fight against COVID-19, we find ourselves in a similar stasis today, though one incomparably safer. The days working from home blend together. We must all find personal and professional patterns during what is likely to be an extended period of uncertainty.

This phase of the war, however, is an important period that will ultimately determine which asset managers ascend to the top of the league table in the next business cycle. These “best-in-class" firms will 1) ensure that the communication and service levels set during the early stages of the COVID response are institutionalized as ongoing processes, 2)find ways to reconnect their high-quality people with investors, and 3) utilize their key differentiators on behalf of the segments they choose to serve.

Further, it’s an important transition phase because many of the industry trends that have emerged are likely to accelerate. For example:

- Industry concentration – Either through M&A or attrition (firms closing their doors)

- Enhanced use of technology – To enhance investment processes and distribution efficiency

- Demand for advice – As investors struggle with increasingly complex markets

- Professional marketing – As managers realize that investor engagement can be a competitive weapon for growth

- Client centrism – In an effort to optimize relationships with key accounts

With no clear timeline for a COVID-19 vaccine, we don’t know how long this phase will last. But, like the soldiers in the trenches, we know that it will end, and that the world will look very different on the other side.

Phase 4: The New World Order

Following the “war to end all wars,” Woodrow Wilson argued for an approach to world governance that would identify, understand and address worldwide problems. President Wilson focused on shared challenges like collective security, democracy and self-determination. Although his vision did not fully come to fruition, the new world order following the war made good progress on these issues.

Likewise, in the wake of the COVID-19 pandemic, the asset management industry is likely to make significant progress on the long-standing challenges that have vexed our industry.

Challenges like how to best align the interests of investors and managers; how to optimize client experiences; how to effectively deploy capital to benefit society; how to leverage technology to optimize investor experiences; how to ensure proper investment oversight and expertise; and how to structure retirement savings plans.

While the answers to these challenges are not yet clear, a raft of established providers, not to mention entrepreneurs, are hard at work on creating innovative solutions. Be on the lookout for new business models, new fee models, opportunities for outsourcing, new approaches to using technology, and more effective uses of data.

History shows that dislocations spawn innovation in industries in need of disruption.

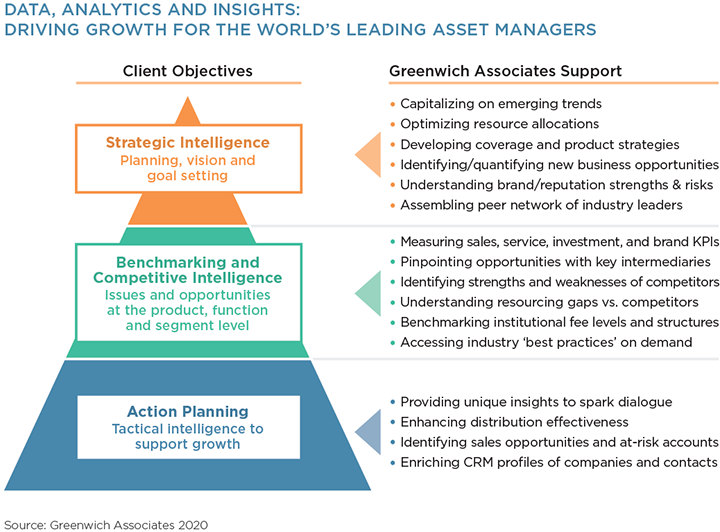

Greenwich Associates is privileged to serve the world’s leading asset managers and investment consultants assess and refine their business strategies through our data, analytics and insights. We hope that you have found our "Pandemic Perspectives” blog series helpful during the early days of the COVID crisis.

We are excited about the opportunity to help our clients successfully navigate the uncertain environment in the months ahead. Please do not hesitate to reach out to us to discuss your specific needs.

Part 1 – Greenwich Investor Resilience Index

Part 2 – Lessons from the Past

Part 3 – Supporting Consultants During Coronavirus

Part 4 – Asset Manager Service Quality: Pre- and Post-COVID-19 Onset

Part 5 – Leading Through Crisis

Part 6 – Useful Content in Times of Crisis

Part 7 – Managers Adapting Through Crisis

Part 8 – Using Analytics to Transform Sales, Win New Assets