Banks that limit their customer experience management (CEM) programs to “front-office” or customer-facing staff are not addressing every element that affects customers.

Banks that limit their customer experience management (CEM) programs to “front-office” or customer-facing staff are not addressing every element that affects customers.

In this paper, we will show how commercial banks can employ CEM principles and techniques to energize internal referral processes to boost new customer acquisition and expand share of wallet with existing clients.

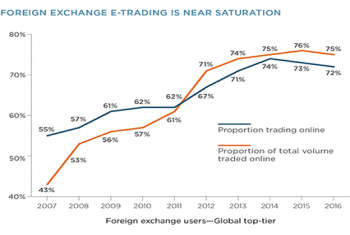

The impressive adoption of e-trading in FX over the past decade stands out not only versus other asset classes, but also because it has developed via natural market demand and not regulatory mandate.

Insight Investment is the 2017 Greenwich Quality Leader℠ in U.K. Institutional Investment Management Service. Insight received market-leading rankings on multiple key service success factors and is the clear overall market leader.

Bond dealing desks are different than they once were. Phones are used less, computers more, and compliance requirements are now handled with the highest priority—all while technology budgets and headcounts have been reduced. But as we edge closer to...

For the 12 months through Q1 2017, however, total U.S. equity commissions dropped 13%.

European institutions contending with a set of formidable challenges—including sweeping regulatory reforms, persistently low interest rates and the threat of increased volatility—are turning to asset management firms for advice and assistance on...

Over the past several years, institutions in Germany and across the Continent have been forced to devote significant resources and attention to complying with the ongoing implementation of new rules, including EMIR, Solvency II and MiFID II, and to...

PIMCO is the 2017 Greenwich Quality Leader℠ in Asian Institutional Investment Management Service.

J.P. Morgan, Morgan Stanley and Goldman Sachs top the list of Greenwich Associates 2017 Share Leaders℠ in U.S. Equities, besting all rivals in both research/advisory vote share and trading commission share.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder