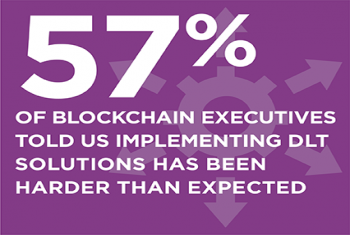

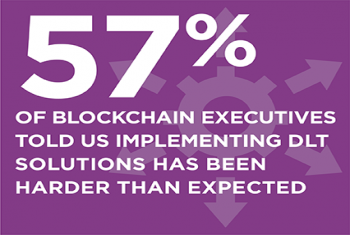

In this report, we look at some of the key technical challenges executives are facing and analyze their approach to solving them.

In this report, we look at some of the key technical challenges executives are facing and analyze their approach to solving them.

Announcing the 2018 Greenwich Excellence Awards for U.S. Large Corporate Finance... More than 70 banks were evaluated and seven had distinctive quality.

Explicit unbundling of research/advisory payment and “best execution” moved to the fore after MiFID II’s implementation in January 2018.

Fixed-income dealers that invested in their businesses over the past year are positioning themselves to capitalize on an anticipated pickup in market volatility and investor activity.

RBC Capital Markets and TD Securities are deadlocked atop a newly competitive Canadian fixed-income market.

Institutional assets available to asset management firms in Asia topped $3 trillion for the first time this year, as central banks, large pension funds and other institutional investors continued diversifying their portfolios and outsourcing assets...

U.K. investment managers are working to maintain and enhance profit margins in the face of downward pressure on management fees.

In their ongoing search for yield, German institutional investors are trimming allocations across fixed income and shifting funds to real assets and certain equity products.

The results of the Greenwich Associates 2018 Continental European Institutional Investors Study reveal three prominent trends that are changing European portfolios and creating new opportunities for asset managers competing in the region.

The pool of commissions earned by brokers on trades of U.S. equities within the Greenwich Associates universe contracted another 9% last year to an estimated $7.65 billion.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder