5 Quick Thoughts: Market Structure and Today's Sell Off

Some quick thoughts on market structure as we head into today's sell off.

Some quick thoughts on market structure as we head into today's sell off.

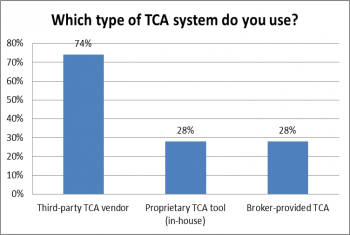

As MiFID II turns up the pressure on the delineation of payment for research versus execution, institutional investors may soon increase their attention on brokerage services that materially enhance multiple aspect of their execution process.

No new swaps have been mandated to trade on SEFs since the original determinations were made two years ago. The CFTC recently called a panel to understand why and what they should do to change the logjam we are in the middle of now. We were pleased...

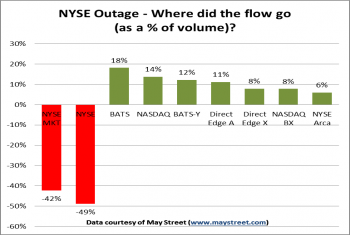

The extended discussion surrounding the NYSE outage from last Wednesday seems your typical case of rubbernecking. Maybe it's wishful thinking that this event will fit neatly with the Flash Boys script, painting the US equity markets in disarray due...

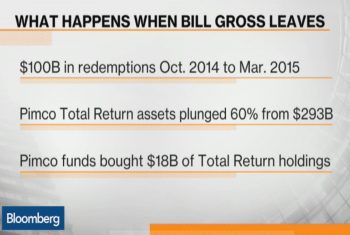

When Bill Gross left PIMCO many in the market were concerned that the expected outflows would crush bond prices as they were forced to sell.

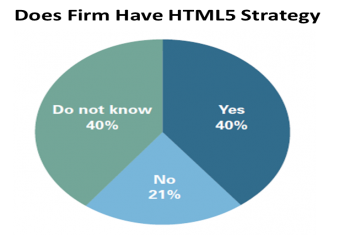

Growing uncertainty about the future of operating systems and devices used by financial services firms is forcing technologists to consider technology-agnostic application development. Our latest research suggests that companies developing...

A move by the European regulators to “unbundle” payments for research from commissions paid on equity trades will have potentially significant and negative consequences for both the buy side and sell side.

We recently published new research examining the use of Fixed Income ETFs by institutional investors.

Excel is the biggest killer app of all time. Yeah, web browsers are pretty useful and Instagram was sold for $1 billion, but when it comes to managing numbers nothing can touch Excel. This is why global financial markets continue to be run by Excel...

A crisis is a crisis because most people didn't see it coming. Unexpected events freaks people out causing a bad chain of events - a crisis. So despite evidence that a liquidity crisis is on the horizon in the bond market, wide spread recognition...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder