Systemic Risk and the Impacts of Central Clearing

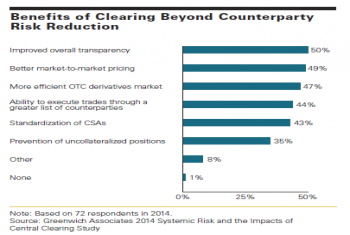

Central clearing of derivatives is leading the charge toward systemic risk reduction.

Central clearing of derivatives is leading the charge toward systemic risk reduction.

Over the medium and long term, futures products will gain traction at the expense of more standardized cleared swaps.

Fundamental changes in investor demand are making the “solutions” approach relevant to all asset managers—including both firms that will pursue solutions strategies as a means of growing their businesses and firms that will...

While past performance and brand strength are less important for selection onto intermediaries’ platforms, they are clear drivers for attracting assets from clients.

European asset managers are at the forefront of a move by institutional investors to integrate exchange-traded funds (ETFs) into their investment portfolios.

Yen fixed-income trading volume increased 25% this past year and the aggregate market share of the five largest Japanese dealers now accounts for more than 56%.

While commission rates on equity trades vary from country to country and from developed to emerging markets, new research reveals that commission rates vary from investor to investor within markets.

Zions Bancorp takes top honors for 2014 Greenwich Excellence Middle Market Banking.

Four banks take top honors for 2014 Greenwich Excellence Mid-Corporate Banking.

Small and regional banks dominate the 2014 Greenwich Excellence Awards for Satisfaction and Quality.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder