Buyer’s Market For Asian Companies Seeking Credit

Competition among a large and diverse group of banks has created a buyer’s market for companies in need of credit and other banking services.

Competition among a large and diverse group of banks has created a buyer’s market for companies in need of credit and other banking services.

The concept of trading multiple asset classes through a single trading system is alluring, but traders' appetite for the systems shows a disconnect between the model and its practicality.

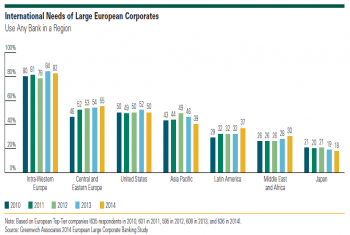

Large European companies are turning to foreign banks specializing in specific international markets.

Trading volume in Foreign Exchange products increased 26% among financial investors in the United States in 2014.

Trading volume in Foreign Exchange products increased 3% among corporate investors in the United States in 2014.

Trading volume in Foreign Exchange products increased 6% in Latin America in 2014.

Trading volume in Foreign Exchange products decreased 11% in Japan in 2014.

Trading volume is up over 30% on a matched sample basis.

Trading volume in Foreign Exchange products increased 65% across Asia ex. Australia, New Zealand and Japan on a match-sample basis in 2014.

Trading volume in Foreign Exchange products increased 8% in the United kingdom in 2014.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder