Japanese Brokers’ Big Bets Pay Off

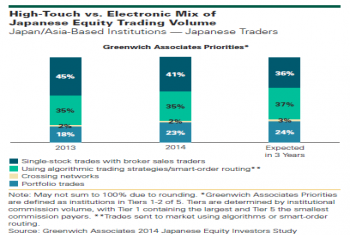

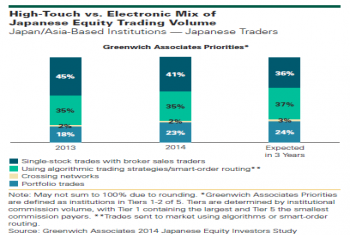

Japan’s large equity brokers are capturing considerable market share with foreign investors active in Japanese equities.

Japan’s large equity brokers are capturing considerable market share with foreign investors active in Japanese equities.

In a time increasingly defined by the implementation and consequences of new regulations, Deutsche Bank has established itself as the leader in global fixed- income trading market share, while J.P. Morgan and Citi have distinguished themselves by...

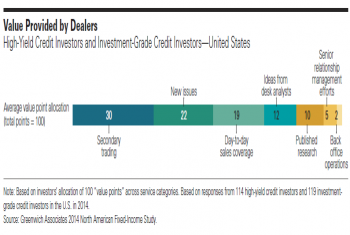

Since matching the buyer and seller for a bond trade remains principally in the realm of intuition and experience, defining "best execution" can be an elusive endeavor.

Demand for global equity is expected to be strong next year along with U.S. equity and emerging markets.

With the exception of U.S. equity, fees appears to have stabilized and active non+Canadian fixed income increased driven by specialty mandates.

While funding levels remain the key issue, risk management increased in importance across both corporate and public funds.

DB plans dominate both corporate and public plans, but DC plans are anticipated to make inroads with corporate plans over the next 10 years.

Allocations to Canadian equity continued their decline while international equity and hedge fund allocations increased modestly.

Corporates are seeking to derisk and diversify while publics actively seeking returns to close persisting funding gaps.

Use of “alternatives” continues to broaden as funds seek return and diversification benefits.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder