Review the ways CEOs, COOs and distribution professionals have come together to address fee pressures, from both revenue generation and cost management perspectives.

Review the ways CEOs, COOs and distribution professionals have come together to address fee pressures, from both revenue generation and cost management perspectives.

Good customer experience is easy to recognize but can be difficult to deliver. For that reason, Greenwich Associates is launching Greenwich CX Leaders—an award recognizing leadership in the increasingly important field of customer experience.

This new Greenwich Report takes a deeper dive into what it will take for asset managers to compete and succeed in a maturing industry.

This report examines the current state of the fixed-income business, top concerns of both large and middle-market dealers, technology priorities, and the most likely path forward.

Announcing the 2018 Greenwich Excellence Awards for Large Corporate Trade Finance... More than 270 banks were evaluated and six had distinctive quality...

While it remains too early to assess the exact impact on the world’s economy, trade disputes and new trade barriers are adding uncertainties for corporates worldwide and are likely to have an impact on the broader trade finance landscape.

Technology has been both the cause and effect of massive change across the capital markets. Whereas technology was once fighting to keep up with the demands of the business, trading desk heads today often struggle to keep up with the latest and...

The U.S. corporate banking market is on the cusp of a revolution, with relationship strength and wallet allocation increasingly driven by effective process digitization.

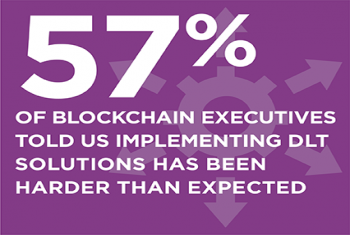

In this report, we look at some of the key technical challenges executives are facing and analyze their approach to solving them.

Announcing the 2018 Greenwich Excellence Awards for U.S. Large Corporate Finance... More than 70 banks were evaluated and seven had distinctive quality.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder