Increased U.S. Treasury market volatility resulted in a good month for electronic trading. Electronic trading doesn't always equate to liquidity, however. The Greenwich UST liquidity score dropped from last month.

Rebounding from Change: An Investment Manager's Toolkit

Investment managers are well-advised to evaluate their own ability to rebound from change, including the tools and resources they have in place, and the steps that they are taking to continue to develop this capability.

Distributed ledger technology (DLT) has a big role to play in improving the quality of the settlement infrastructure, but it may not be able to replace it entirely without imposing the very costs it was designed to reduce.

The final phase of uncleared margin rules (UMR) could trigger a shift in FX options trading from OTC to exchange-based trading.

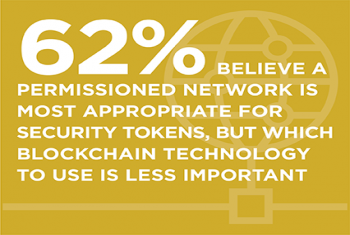

New research looks into the emerging market for security tokens, identifying the most promising applications, key advantages and leading players in the space.

The FX industry is no stranger to mergers and acquistions. Since 2006, there have been 11 major transactions, with the pace only accelerating.

Canadian Institutions Turn to ETFs in Challenging Markets

Canadian institutions made aggressive use of exchange-traded funds in their portfolios last year as they navigated a sharp market downturn, a surge in volatility and a series of unpredictable geopolitical events.

The fast growing Asian fixed-income markets have attracted investors from the region and abroad.

Alternative data has been around for at least a decade, but an increase in adoption is making it less “alternative” and a more essential part of portfolio construction.

Greenwich Associates senior analysts take a closer look at the U.S. Treasury market as of April 2019.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

The Trade: Speaking to The TRADE, Jesse Forster, head of equity market structure and technology at...August 14, 2025

-

GRR: “I think it’s the go-forward strategy for most of the banks, where you do have to lend to some...August 13, 2025

-

Markets Media: TCA, which started decades ago as primarily a “box-checking” process to document...August 13, 2025