2017 was politically strange, economically strong and eerily calm. President Trump attempted to govern the U.S. in ways never before seen and often hard to imagine. Britain seemed to second-guess their choice to leave the EU while carrying on...

2017 was politically strange, economically strong and eerily calm. President Trump attempted to govern the U.S. in ways never before seen and often hard to imagine. Britain seemed to second-guess their choice to leave the EU while carrying on...

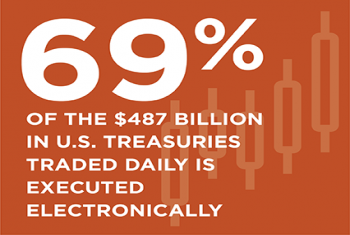

Close to a half trillion dollars in U.S. Treasury bonds trade every day, and Greenwich Associates estimates over two-thirds of this volume trades electronically.

In the face of the growth in FX futures trading, Greenwich Associates examines and assesses the potential economic benefits of utilizing futures as an alternative to trading in the OTC markets.

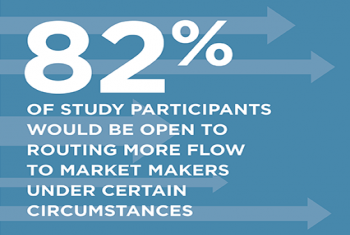

Market making in U.S. equity markets has changed significantly in the last two decades.

After bracing for a coming chill, investment management professionals are instead enjoying an unexpectedly favorable climate in terms of year-end compensation. But make no mistake: Winter may be coming, so asset management firms and professionals...

Fixed-income dealers are spending $15-$20 billion a year on RegTech, or regulatory technology, that helps them comply with the raft of regulations covering their trading desks.

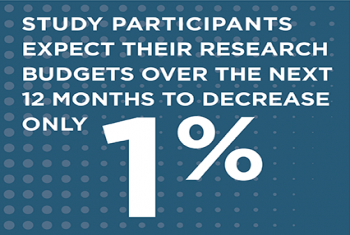

The MiFID II directives will surely bring significant changes to the financial industry. With increased scrutiny and a brighter spotlight shining on established investment processes, every affected party will have to adapt—a daunting prospect.

Not all benchmarks and, perhaps more importantly, not all benchmark calculations are alike and while always important, several macro factors have added additional complexity to the task of benchmark selection.

Dramatic advances in artifical intelligence (AI) are quickly changing this technology from a banking buzzword to a critical capability that helps drive better outcomes for clients.

If providing technology to enable electronic trading of corporate bonds was the first phase of the market’s evolution, then gathering, analyzing and putting data to work is phase two.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder