This new Greenwich Report shows how an increased focus on best execution and the growing use of transaction cost analysis (TCA) are fueling the adoption of algorithms in foreign exchange.

This new Greenwich Report shows how an increased focus on best execution and the growing use of transaction cost analysis (TCA) are fueling the adoption of algorithms in foreign exchange.

Approximately 60% of Indian middle-market companies expect the implementation of the national Goods and Services Tax to have a positive impact on their businesses.

With research fully unbundled from trading, asset managers will select their trading counterparties based solely on their trading prowess. MiFID II regulations also include new rules specifically addressing...

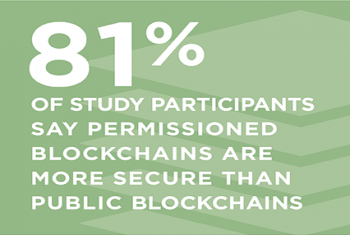

To increase adoption, speed development and foster community, many blockchain technology companies are deciding to distribute their software...

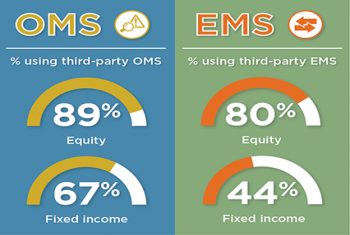

The buy side can’t live without their order and execution management systems and increasingly are looking outside to gain access to the latest and greatest platforms on the market.

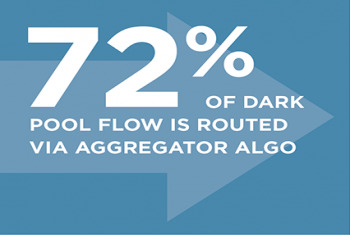

Often frustrated by the fragmentation of U.S. equity markets, the buy side has always valued dark pools, where they can source unique liquidity or execute...

The biggest conundrum facing both the buy and sell side in light of MiFID II is how to put a value on research.

Trading corporate bonds is finally getting a little easier and what we are seeing is an adaptation to the current market structure and with that, a smaller but much more efficient buy-side trading desk.

While many banks and financial institutions cite loyalty or customer experience as top strategic priorities, surprisingly few firms are fully realizing the potential value from their programs.

Even as trading has become more electronic and geographically diverse, the role of voice communication remains as important a partof the trading process today as it was all those centuries ago.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder