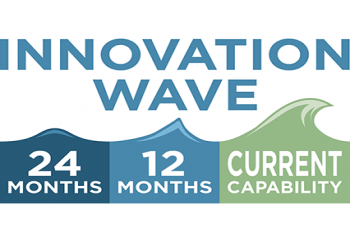

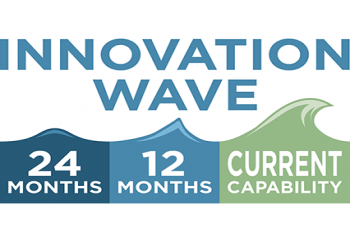

Eight characteristics that define Best-of-Breed Platforms of digital banking; Priorities for today and tomorrow

Eight characteristics that define Best-of-Breed Platforms of digital banking; Priorities for today and tomorrow

There are many market structure issues that have been much discussed topics since the passage of Reg NMS, such as high-frequency trading, dark liquidity, co-location, and fee structures.

Greenwich Associates has unique insights to help consultants and managers quantify the value of specialization through client segmentation. Our findings are based on data regarding investment consulting firms and are also applicable to investment...

For many finance executives, social media is an important part of their professional lives. It is used to engage with peers and colleagues, to research sales leads, to learn from industry leaders, and even as a source of alpha for certain strategies...

The top five dealers in U.S. Treasuries handled 58% of client trading volume in 2016, and the top 10 a collective 85%.

Sell-side trading desks have been upended by structural and cyclical changes. It is clear to most that the previous playbook doesn’t work all that well anymore, and revisions need to be made to remain relevant and ensure growth over the next decade...

The use of commission management programs (CMPs)—commission sharing arrangements (CSAs) and client commission agreements (CCAs)—has been a topic of discussion for years. CMPs have been a valuable tool used by institutional buy-side investors to help...

The fixed-income market is all about borrowing money to finance capital investments, allowing those that need it to borrow it from those that have it. From their early beginnings over 400 years ago, bonds have helped the global economy expand faster...

The difficult trading environment in bond markets is fueling the use of bond ETFs in institutional portfolios.

LinkedIn and Greenwich Associates conducted a study to identify how wealth managers can successfully engage HNW Millennials and Generation X along their customer journey.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder