Unique Markets Present Unique Opportunity for Wealth Managers

The pandemic-led market events created tremendous opportunity for financial advisors by accelerating the pace of change.

The pandemic-led market events created tremendous opportunity for financial advisors by accelerating the pace of change.

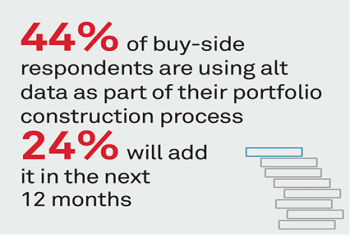

The urgency of managing alternative datasets is forcing asset managers and asset owners to consider a more modernized architecture and approach to systems.

Asset managers are working to create “client-centric” business models that allow them to deliver superior service to all clients and to partner with their best clients as strategic advisors.

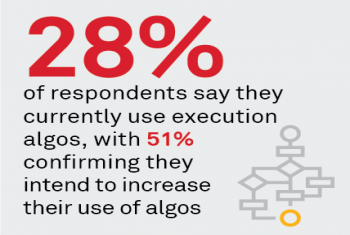

For a decade, U.S. institutions have been spending less on execution and research year over year.

Over the past two decades, risk management infrastructure has transformed from an almost sole focus on conduct risk to a significantly expanded view that encompasses regulatory, reputational, operational, and technology risk.

Regionally, APAC and Americas were affected the most by the lower interest rate environment, partially offset by higher fees. EMEA, on the other hand, outperformed led by better performances in the European markets.

Following several years of stable contribution of U.S. Commercial Banking relative to CIB to the overall industry pools, FY20 and 1H21 saw a relative decline in the contribution from U.S. Commercial Banking.

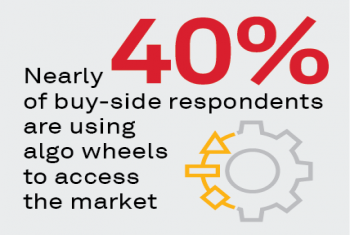

Buy-side participants in the FX market are increasingly focusing on the performance of FX trading and the need to improve it.

In this report, we address why many investors fail to take advantage of the performance associated with innovation, and we suggest how to target and take on exposure to innovation in portfolios.

2Q21 Coalition Index Investment Banking revenues were down by (13)% on a YoY basis.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder