The derivatives industry is braced for change spurred on by a wide variety of factors, ranging from regulation to technology to emerging asset classes.

The derivatives industry is braced for change spurred on by a wide variety of factors, ranging from regulation to technology to emerging asset classes.

This new report explores how OTC IRD are used today and what changes are coming to the market in 2022 and beyond.

Investment in “wealthtech,” or digital solutions that facilitate wealth management processes, hit record levels in 2021. Demand has been driven by a number of major acquisitions emblematic of what could be described as an industry renaissance.

As 2021 comes to a close, Libor activity remains... but for how long?

Whether it’s market structure modernization, movement on crypto or market data itself, we know that there will continue to be plenty of action out of the Gensler administration.

Controlling risk has been a central theme for banks since the financial crisis of 2008. During that time, U.S. regulators addressed issues concerning practices tied to market making, derivatives exposure, counterparty risk, and more.

The past four years have brought a notable uptick in e-trading of domestic-currency, G10 investment-grade and hard-currency credit in Asia, with domestic-currency bonds leading the way.

U.S. option market volumes caught fire in 2021. Records were made, broken and then almost immediately broken again. The top six volume months in the history of the Options Clearing Corporation (OCC) reporting occurred in 2021.

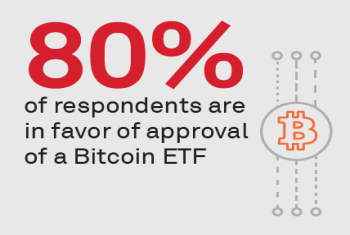

The crypto market’s new level of maturity is driving demand from traditional finance, much of which now accepts it as a new asset class that must be examined closely. This next phase in the evolution of crypto market structure will be highly...

While inflation, supply chain issues, regulation, the pandemic, and central banks’ rate-raising plans will certainly be big drivers of global markets for the foreseeable future, the following set of 10 diverse market structure and technology trends...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder