Investing in Corporate Bond Liquidity: The Dealer View

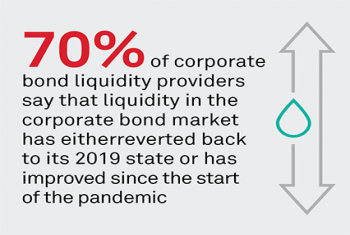

Liquidity in both the investment-grade and high-yield corporate bond markets has either reverted back to its 2019 state or has improved since the start of the pandemic, according to 70% of the corporate bond liquidity providers.