Asset managers are discovering a new tool in the fight for increased profitability in an increasingly competitive institutional market: persona client segmentation.

Asset managers are discovering a new tool in the fight for increased profitability in an increasingly competitive institutional market: persona client segmentation.

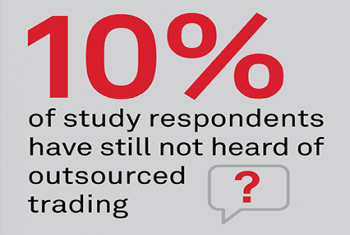

A pandemic. A historic market rout. A historic market rally. An election. Outsourced trading. One of these things does not belong. Or does it?

We believe that the adoption of TCA, especially with enhanced institutional data and greater utilization across the enterprise, will benefit significantly from the trend toward the greater use of analytics across the trading desk.

No one will ever claim that 2020 was a dull year. In this report, we look at U.S. equity market structure topics such as expanding equity exchanges and Reg NMS 2.0 proposals.

The ramifications of new equity exchanges, an increasingly tech-heavy fixed-income market, spending on surveillance technology, clearing and continued cloud adoption are some of the big themes we see shaping 2021.

No market operates in a vacuum. Simultaneously exploring how conditions and activity evolved across asset classes is essential to understanding the strengths and weaknesses of the current market structure.

The shareholder litigation landscape is rapidly changing across the globe.

FX markets continued to function even in the depth of the crisis, with market makers staying active and electronic marketplaces continuing to operate well despite spikes in volume.

The onset of the COVID-19 pandemic created a sustained period of market stress leading to record volumes across over-the-counter (OTC) interest-rate derivatives (IRD) markets. The market infrastructure nevertheless proved both resilient and highly...

Digital capabilities are now taking center stage, as corporates in India accelerate their use of electronic channels. Corporates are again likely to turn to their banking partners to fulfill their needs for innovative and agile trade finance...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder