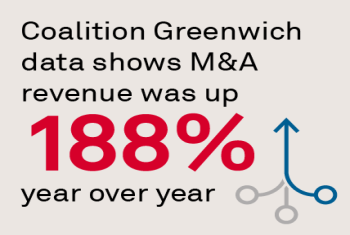

3Q21 Coalition Index Investment Banking revenues were up by 13% on a YoY basis.

Monitoring the Silence: Illuminating Black Holes in Communications Surveillance

Holistic surveillance practices have evolved significantly in recent years, and never more so than during the industry’s historic transition to remote working environments in 2020. Effective surveillance programs depend on key data analysis,...

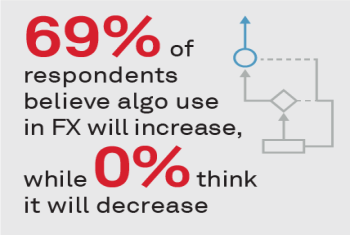

The use of algorithms in FX execution remains less prevalent than in equities. While some motivations to use algos remain consistent (e.g. accessing liquidity), there are new drivers that are changing this part of the market.

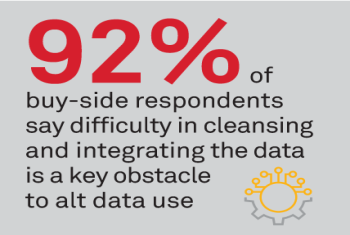

Alt Data for Producers: More than Just the Data

Today, traditional financial information vendors and aggregators have expanded into this market and are developing offerings and marketplaces intended to make discovery, acquisition and ingestion easier than ever.

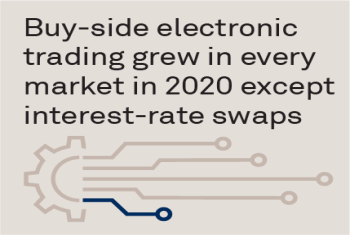

Global Electronic Trading Asset Class Scorecard

A lot has happened since the beginning of 2020, including the growth of electronic trading in nearly every major asset class around the world.

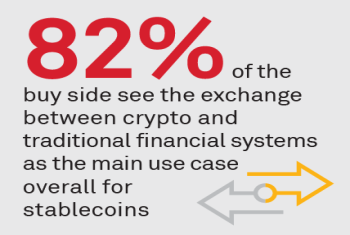

Stablecoins Rock the Boat, Clarity Needed to Calm the Waters

Stablecoins have rocked the boat. Financial institutions and regulators are responding to a new innovation that offers significant advantages for capital markets institutions, such as the exchange between fiat and crypto, rapid settlement, new yield...

Third-quarter revenue for the top five U.S. banks tracked by the Coalition Index for U.S. Banks were up 17% year over year and 45% from the third quarter of 2019.

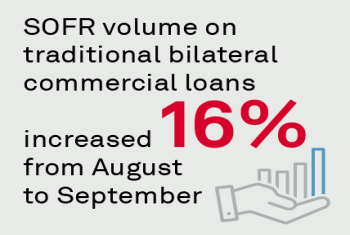

Greenwich Commercial Lending Market Insight - Q4 2021

The year-end mandate to cease Libor-based lending is fast approaching.

For Corporate Banks, the Clock is Ticking on ESG and Sustainability

Companies around the world are introducing ESG and sustainability goals into corporate finance and treasury functions. As they do, corporate banks have a valuable opportunity to deepen client relationships and win new business by helping companies...

Cryptocurrencies: The Road Ahead May Not Be Cryptic Anymore

As cryptocurrency moves from a largely retail product at the edges of the market place to a product that engages a broad set of institutional investors across the financial markets, impediments to wider use will have to be solved.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Traders: Many firms recognize the value of sharing programmatic research, but in practice, reuse is...January 23, 2026

-

Asset Actualidades: In 2025, European companies allocated an impressive 45% of their commercial...January 15, 2026

-

Markets Media: Tokenizing high-quality collateral is “shaping up to be a 2026 game changer,” said...January 8, 2026