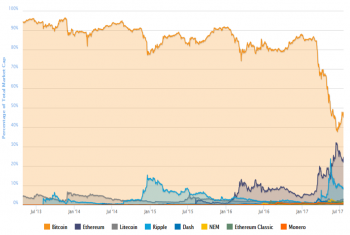

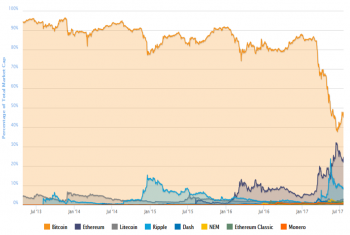

Bitcoin was the original cryptocurrency and it is the largest and most successful. Today, however, there are almost 1,000 other cryptocurrencies and tokens in circulation. In this blog, I will be discussing some of the leading alternative...

Bitcoin was the original cryptocurrency and it is the largest and most successful. Today, however, there are almost 1,000 other cryptocurrencies and tokens in circulation. In this blog, I will be discussing some of the leading alternative...

Investors continue to be thirsty for market structure information. In our most recent U.S. equities study almost half of buy-side respondents told us that sell side provision of market structure related services was either important or very...

While market sizes are often measured in the trillions of dollars, the number of firms that are responsible for the majority of transactions is measured in the hundreds if not the teens - but even though concentrated, competition must always exist.

With French presidential elections out of the way, expect further clarity on Brexit and more competition from French banks.

There is a tremendous amount of irony in the path high-frequency trading - excuse me, principle trading firms have taken from their heyday in the late 2000's. We eluded to this a few months ago in our top market structure trends to watch in 2017.

Any lingering uncertainty about Brexit moving forward has been swept away. It’s time for companies to start preparing—although for what is unclear.

By now everyone understands that the new regulations will fundamentally change the business models of brokers and asset managers. Yet despite...

The SEC decision on whether to approve a Bitcoin ETF was never going to be a make or break moment for the crypto-currency.

It has been 7 years since Dodd-Frank was passed, and four years since clearing mandates took effect in the US, and clearing swaps for customers still falls short of the great business opportunity most FCMs had hoped for when Dodd-Frank first became...

Fundamental change may be coming to U.S. equity markets, and it’s not just because of the new Trump administration.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder