Social media has become ubiquitous and in large part defines how we interact in a busy digital age. But not every platform is created equal, especially not for business and investing. We recently interviewed 256 institutional investors—pensions,...

Social media has become ubiquitous and in large part defines how we interact in a busy digital age. But not every platform is created equal, especially not for business and investing. We recently interviewed 256 institutional investors—pensions,...

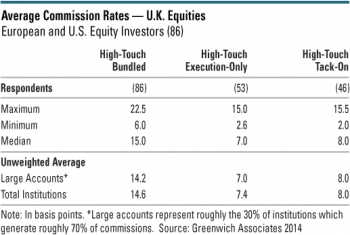

Our recent report, “Equity Trade Commissions: Rates Vary Broadly Across and Within Markets,” highlighted an interesting finding from a Greenwich Associates study: average bundled commission rates on equity trades are surprisingly consistent across...

Larger institutions in Japan now execute only roughly 41% of trades as traditional single stock high-touch trades, well down from 48% in 2011.

Central bank policy shouldn't really be part of the market structure story. Market structure is about regulatory change, technology innovation and market reactions to the evolving competitive landscape.

Institutions in Asia are executing a steadily increasing proportion of business on a low-touch basis (algorithms, DMA, crossing, portfolio trades) as opposed to traditional high-touch business executed through a broker sales trader.

Our conversations with dealers over the past few months have left us wondering if volume weighted market share is the right metric for gauging success in fixed income dealing. In past years market share always brought with it bragging rights, both...

The market has been talking about this since at least 2009: swaps clearing will reduce systemic risk and take most of the counterparty risk out of the swaps market. Yet despite this risk reduction, regulators still seem determined to make the...

The European Commission, ESMA and the FCA appear to be including fixed income in new payment for research requirements in MiFID II and EMiR by not explicitly excluding fixed income research.

We might be getting a little bit closer to understanding whether or not the changes in the capital markets are cyclical or structural. We view volatility - or the lack thereof - as a major factor impacting profitability across financial services....

The corporate bond market is starting to feel a lot like the swaps market did in 2010. There is no electronic trading mandate for corporate bonds of course, but a proliferation of new bond trading platforms and initiatives is upon us akin to the...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder