ETFs: U.S. Institutions' New Tool of Choice for Portfolio Construction

Investments in ETFs by U.S. Institutions increased significantly in 2018, with average allocations jumping to nearly 25% of total assets, up from almost 19% in 2017.

Investments in ETFs by U.S. Institutions increased significantly in 2018, with average allocations jumping to nearly 25% of total assets, up from almost 19% in 2017.

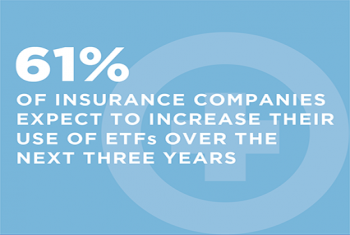

ETFs have long been used by insurance companies for equity exposure, but a change in the statutory accounting treatment of fixed income ETFs has helped open up the rest of an insurance company’s general account for increased use of the vehicle.

The average buy-side trading budget grew 8% year-over-year, to $2.73 million.

Greenwich Associates takes the temperature of the marketplace regarding important equity market structure regulatory developments including unlisted trading privileges, the Consolidated Audit Trail and the Transaction Fee Pilot.

Trading and clearing business goes to those people that provide the best service, market color and tightest pricing. The swaps market should not rest...

An interesting facet of market structure is how flexible markets can be, twisting and turning to conform with the nature of the product, the legal and regulatory environment in which they operate and the scope of the buyers and sellers they’re...

Following the passage of MiFID I, electronic trading in Europe grew 250% from 2007 to 2010. In this research, Greenwich Associates takes a look at the early days of the MiFID II trading transformation by making informed predictions based on the...

The boom in new corporate bond trading platforms is over. Institutional corporate bond investors have voted with their feet, utilizing those tools that work best within the current market structure. We are now in a phase of refinement, where the...

Market structure change over the past decade has been directly or indirectly catalyzed by the credit crisis of 2008. That post-credit crisis era is now over. Here are the Top 9 Market Structure Trends for 2019 from Greenwich Associates.

Learn about the major trends fueling the expansion of ETFs within the investment portfolios of U.S. RIAs, and how they will impact future investments and portfolio allocations.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder